Some Known Questions About Independent Financial Advisor Canada.

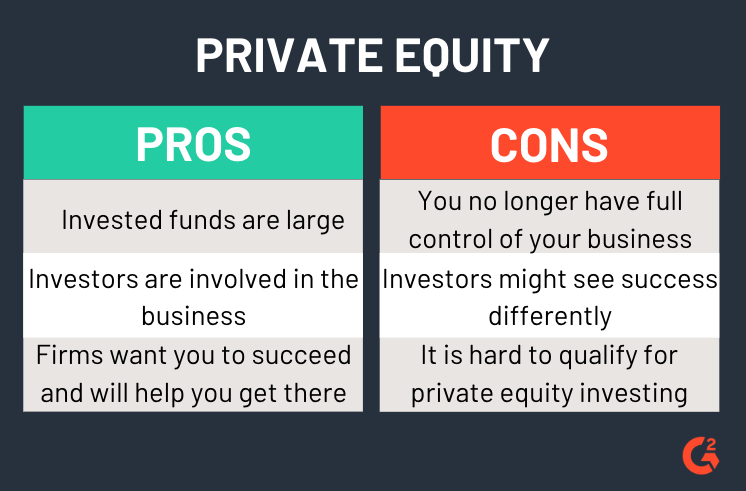

it is things such as budgeting, planning pension or paying down debt. And like getting a pc from a dependable company, buyers wish to know they might be purchasing financial guidance from a trusted specialist. Among Purda and Ashworth’s most interesting results is around the costs that financial coordinators demand their clients.

This conducted true regardless the cost structurehourly, payment, assets under control or flat fee (during the research, the dollar property value charges was exactly the same in each instance). “It still boils down to the worth proposition and doubt throughout the consumers’ part that they don’t know very well what they might be getting into exchange of these charges,” claims Purda.

Not known Details About Retirement Planning Canada

Listen to this article whenever you listen to the word economic specialist, what pops into the mind? A lot of people think of specialized who are able to provide them with economic guidance, specially when considering investing. That’s a good place to begin, however it doesn’t paint the total image. Not really close! Economic experts can people with a bunch of additional money goals too.

A financial advisor can help you create wide range and shield it for the lasting. They're able to calculate your own future monetary needs and program ways to stretch your your retirement cost savings. Capable additionally counsel you on when you should begin tapping into personal protection and utilizing money inside retirement reports in order to prevent any nasty charges.

Some Ideas on Ia Wealth Management You Should Know

Capable help you find out what shared resources are best for your needs and demonstrate how exactly to control and work out probably the most of opportunities. They are able to also assist you to comprehend the risks and just what you’ll ought to do to obtain your goals. An experienced investment professional can also help you remain on the roller coaster of investingeven as soon as your investments just take a dive.

They are able to provide you with the advice you'll want to create a strategy to help you ensure that your wishes are performed. And also you can’t place a price label regarding comfort that accompany that. Based on a recent study, an average 65-year-old couple in 2022 requires about $315,000 saved to cover health care expenses in retirement.

Not known Facts About Retirement Planning Canada

Now that we’ve gone over what economic experts would, let’s dig into the differing kinds. Here’s an excellent guideline: All economic planners are financial advisors, yet not all experts are planners - https://www.pinterest.ca/pin/1151162354742517956. A financial planner focuses on helping folks create intends to reach lasting goalsthings like starting a college account or keeping for a down cost on property

How do you understand which financial specialist suits you - https://dzone.com/users/5075253/lighthousewm.html? Listed below are some steps you can take to be sure you’re employing suitable person. What do you do if you have two bad choices to select? Effortless! Discover even more solutions. The more solutions you really have, a lot more likely you're to produce good decision

The Single Strategy To Use For Ia Wealth Management

Our Smart, Vestor program makes it simple for you by revealing you around five economic experts who are able to serve you. The good thing is actually, it’s free for related to an advisor! And don’t forget about to get to the interview ready with a list of concerns to ask to decide if they’re a great fit.

But pay attention, even though a specialist is actually smarter compared to average keep doesn’t provide them with the ability to let you know how to handle it. Sometimes, experts are full of themselves simply because they do have more levels than a thermometer. If an advisor starts talking down to you, it’s time and energy to demonstrate to them the door.

Remember that! It’s essential plus economic consultant (whomever it eventually ends up being) are on the exact same page. You want a specialist who has got a lasting investing strategysomeone who’ll encourage that hold investing consistently whether the marketplace is up or down. financial advisor victoria bc. You don’t wish to deal with an individual who pushes that buy something which’s as well risky or you’re uncomfortable with

Not known Factual Statements About Retirement Planning Canada

That blend will give you the variation you need to effectively invest your long term. While you research monetary analysts, you’ll most likely encounter the definition of fiduciary responsibility. This all implies is actually any expert you hire has got to act in a manner that benefits their customer and not unique self-interest.

:max_bytes(150000):strip_icc()/ShouldIHireaFinancialAdvisor_1-eb901a47a822420894ee5539073c8473.jpg)